Turning 65 is an important life milestone

It means you are eligible for Medicare. Whether you are retired, or actively working, you will have important decisions to make upon Medicare eligibility. These decisions have immediate and long term implications. The purpose of this guide is to provide a foundational understanding of Medicare while identifying situational factors that can affect your Medicare choices and transition timeline.

The Daywalt Group is your trusted partner, guiding you seamlessly through this education and transition period. While the concepts of Medicare may initially appear confusing, this page will explain Medicare fundamentals, provide answers to many of your questions and give you confidence to choose the optimal time to transition.

What is Medicare?

Medicare is a federal health insurance program for:

People 65 years old or older

Individuals who have been receiving disability benefits for at least 24 months

Illnesses such as End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS)

UNDERSTANDING THE A, B, C AND Ds OF MEDICARE

Part A

HOSPITAL CARE

Part B

MEDICAL CARE

ORIGINAL MEDICARE

Part C

MEDICARE ADVANTAGE

Part D

PRESCRIPTION DRUGS

OFFERED BY PRIVATE INSURANCE

LET’S LOOK AT HOW EACH OF THESE PARTS ARE DESIGNED TO WORK FOR YOU…

Original Medicare - Part A and Part B

Together, Parts A & B are known as Original Medicare, which is provided by the federal government. Coverage for Part A begins automatically if you take Social Security benefits when you turn 65. If you are still working when you turn 65 and have access to group health coverage, you can defer Part B.

Part A - Hospital Insurance

WHAT IT COVERS:

Inpatient hospital services

Skilled nursing facilities

Hospice care

Some home health care

WHAT YOU PAY:

Part A is provided at no cost for most people who have worked at least 40 quarters in their lifetime. It’s funded by the Social Security tax you and your employers have already paid. If, however, you or your spouse have paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

Part B - Medical Insurance

WHAT IT COVERS:

Inpatient hospital services

Skilled nursing facilities

Hospice care

Some home health care

WHAT YOU PAY:

Part A is provided at no cost for most people who have worked at least 40 quarters in their lifetime. It’s funded by the Social Security tax you and your employers have already paid. If, however, you or your spouse have paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

Medical and Prescription Drug Coverage

Medicare Parts C & D are medical and prescription drug coverage plans offered by private insurers to help beneficiaries pay a portion of health care and drug costs not covered by Original Medicare including deductibles and coinsurance payments.

Part C

Medicare Advantage

WHAT IT COVERS:

All Original Medicare services, plus sometimes extra benefits like:

Rx plans

Hearing coverage

Fitness memberships

Dental coverage

Vision coverage

WHAT YOU PAY:

You may pay a monthly premium to a private insurance plan while continuing to pay a premium to the federal government for Part B. Part C plans include an out-of-pocket maximum on covered medical costs. Important note: You are required to have Parts A and B as well as live in the plan’s service area before you can enroll in a Medicare Advantage plan. Many Part C plans are offered at $0 premium.

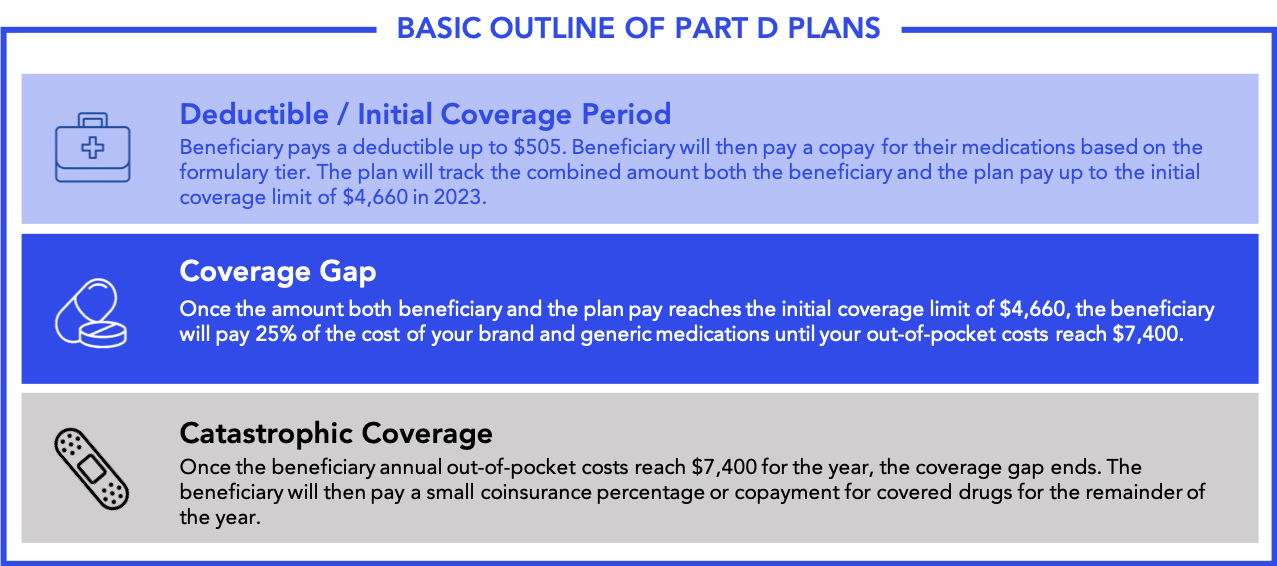

Part D

Prescription Drug Coverage

WHAT IT COVERS:

Part D covers Medicare-approved prescription drugs.

WHAT YOU PAY:

A standalone Part D plan can be purchased through a private health plan if combined with Original Medicare or a Medicare Supplement. Part D programs are often included in Medicare Advantage programs.

Important note: You can only enroll in Medicare Part D if you have Part A and/or Part B coverage.

For informational purposes only.

Medicare Supplement Plans

COVERING THE “GAPS” OF ORIGINAL MEDICARE

Medicare Supplement (also known as Medigap) Plans are supplemental health insurance plans designed to cover services that Original Medicare only partially covers or does not cover, such as co-insurance, copayments and deductibles. Essentially, the plans cover the “gaps” between what Original Medicare pays and the total expenses.

There are a wide range of plans offered by private insurance companies and are standardized, meaning that the benefits are similar from company to company. Rates at initial purchase and annually thereafter will vary. Medicare Supplement plans do not use a provider network. You may use any provider that accepts Medicare. The plans are identified using letters of the alphabet. The Medicare Supplement plans currently on the market are Plans A, B, C, D, F, high deductible F, G, K, L, M, & N.

The chart below shows basic information about the different benefits that the Medigap plans cover.

For informational purposes only.

MEDICARE SUPPLEMENT PLANS VS. MEDICARE ADVANTAGE

WHAT ARE THE ENROLLMENT PERIODS FOR MEDICARE?

-

INITIAL ENROLLMENT PERIOD

The Initial enrollment period begins 3 months before your 65th birthday and ends 3 months after you turn 65. In case you are not enrolled automatically, contact Social Security about 3 months prior to your 65th birthday if you chose to enroll in Medicare.

If you are still working and are covered under a group plan you can postpone your Medicare enrollment without incurring a penalty for late enrollment.

6 MONTHS BEFORE YOU TURN 65

Familiarize yourself with the basic cost and rules of Medicare. If you are still working, we can help you analyze your Medicare cost equation to determine whether enrollment is optimal. If you are still working but plan to retire in the next year, ask your employer about your options for health benefits once you retire.3 MONTHS BEFORE YOU TURN 65

Begin the process of electing Medicare Part A and/or Part B if you intend to join a Medicare health plan when you turn 65. Think about benefits that are important to your specific health care needs. Let us help you compare plans available to you in your area and decide on a plan that best fits your health care needs.1-2 MONTHS BEFORE YOU TURN 65

Contact us to finalize your Medicare health plan choice and enroll! -

GENERAL ENROLLMENT PERIOD

The GEP is January 1 - March 31 each year. Coverage will start the month after the beneficiary enrolls. If you do not sign up for Medicare when you are first eligible, or do not qualify for a Special Enrollment Period (SEP) you can sign up for Part A and/or Part B during the General Enrollment Period (GEP).

-

SPECIAL ENROLLMENT PERIODS

Transitioning to Medicare from employer group coverage?

If you are covered under a group health plan based on current employment, you can sign up for Part A and/or Part B without a penalty within 8 months of the date employment ends or the group health plan coverage ends, whichever comes first.

Important Note: If your employer has less than 20 employees, and you did not sign up for both Part A and Part B during your Initial Enrollment Period, your employer group health plan could require you pay for services that Medicare would have paid had you been enrolled. This is known as the Secondary Payer Policy which leaves you with increased financial responsibility for claims until your Medicare enrollment is complete.

COBRA coverage is not considered creditable as group health plan coverage. You will be subject to Part B late enrollment penalties if you delay your Medicare Part B enrollment to remain covered under COBRA. It is important to sign up for Medicare before your employment ends or you lose coverage.

Working Past the Age of 65?

Enroll During IEP OR Defer Your Enrollment

ENROLL DURING IEP

Sign up for Medicare Part A and/or Part B and disenroll from your employer group coverage during the initial enrollment period.

DEFER YOUR ENROLLMENT

Because you have coverage as an active employee, you may wait to enroll in Medicare. Be sure to review Medicare plans vs. your employer group coverage plans before making your final decision.